Big Black River Holdings, LLC (“BBRH” or the “Company”), a portfolio company of Jones Capital, LLC (“Jones Capital” or “Jones”), has completed the acquisition of approximately 55,000 acres of timberland and timber reserves from Anderson Tully Company. The acquired properties are located in south west Mississippi, principally along the Mississippi River and Big Black River. The area is nationally known for its excellent deer, turkey and waterfowl hunting, which is attributable to the superior genetic stock of the native deer population, favorable terrain, and years of consistent land and game management practices. The properties are also home to a dense and diverse stand of hardwood timber.

Jonathan Jones, Chief Executive Officer of Jones Capital, stated “Our company history is deeply rooted in the timber industry, dating back to the original Jones Lumber Company established in 1949. Sustainability is one of our core values, and we’re proud to display that through good stewardship of this property.”

BBRH, with its operational partners Good Hope, Inc. and OneSource, Inc. will be engaged in the management of the properties going forward, which includes timber harvesting, reforestation, and forest management, as well as the licensing of land for recreational use and select land purchases and sales.

Perella Weinberg Partners L.P. acted as Anderson Tully Company’s financial advisor. Hogan Lovells LLP as well as Brunini, Grantham, Grower & Hewes, PLLC acted as legal counsel to BBRH, while Eversheds Sutherland (US) LLP acted as legal counsel to Anderson Tully Company.

ABOUT JONES CAPITAL

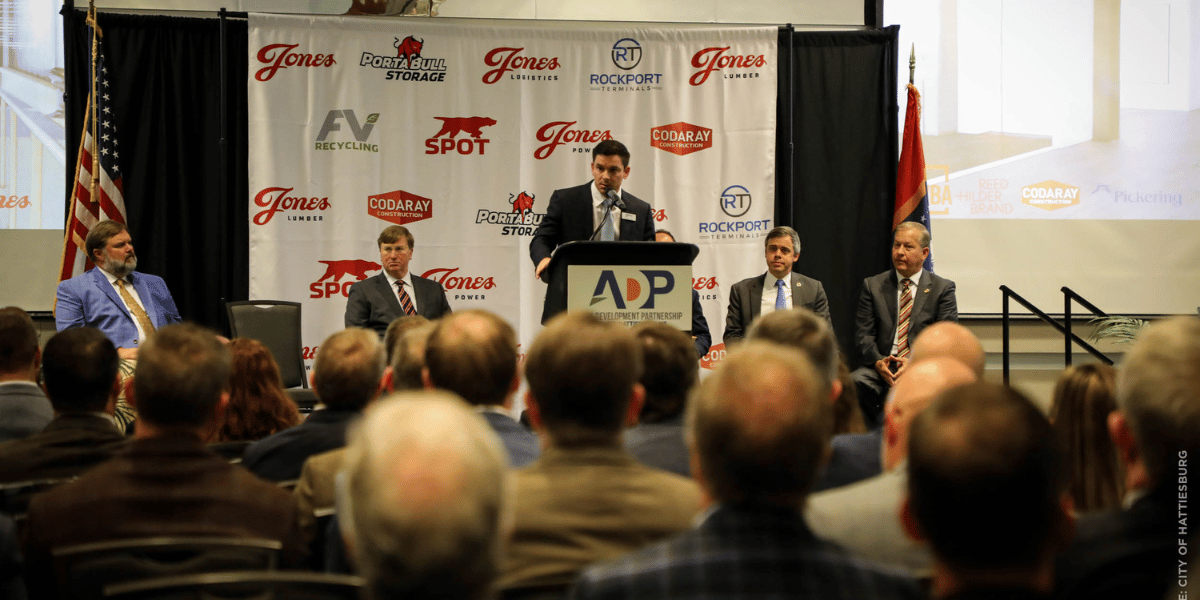

Jones Capital is a privately owned holding company focused primarily on investing in timber, real estate and middle market businesses. Headquartered in Hattiesburg, MS, with offices in Houston, TX, Jones Capital traces its heritage over seven decades to the incorporation of Jones Lumber Company in 1949. Today, Jones’ portfolio currently includes investments in the timber, lumber mill, recycling, trucking and logistics, energy infrastructure services, technology, and real estate industries. Jones Capital is actively seeking new investment opportunities in its core market verticals. For more information, visit Jones.com.

Jones Capital

Jones Capital